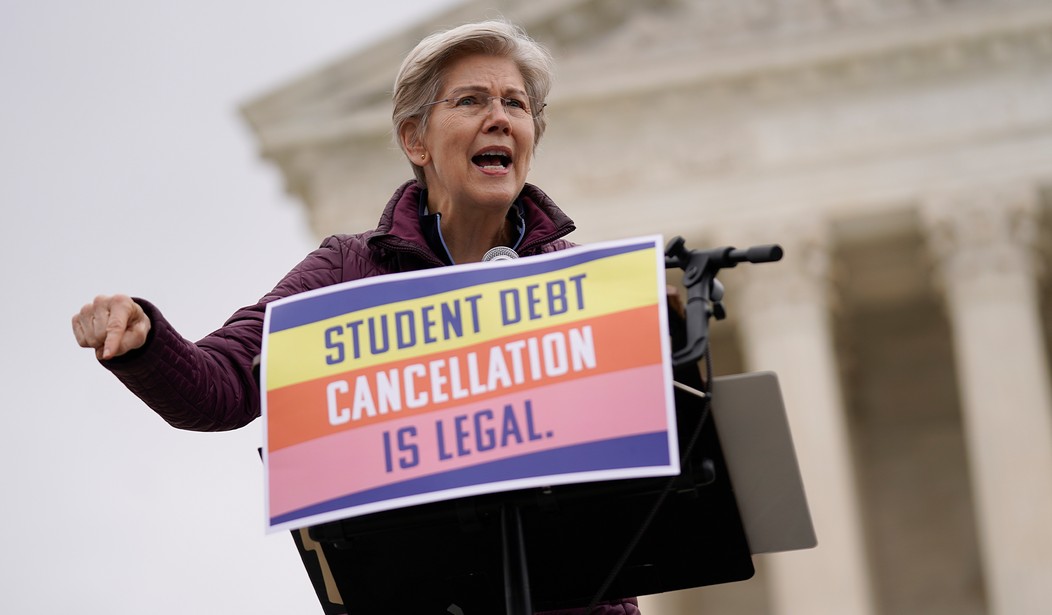

The country is still on edge over the second and third-largest bank collapses in history coming in a matter of days. The Fed is insisting that all depositors will be able to access their money, but the proof of that claim will be in the cash pudding. Either way, there is no way to paint any lipstick on this particular pig and confidence in the nation’s banking system is approaching lows not seen since the collapse of 2008. Given her alleged background in financial regulation, you would imagine that Elizabeth Warren would have something to say on the subject and you would be correct. She penned an op-ed for the Gray Lady today expressing her dismay over the situation. But rather than worrying about the stability of the banking sector, Warren seemed much more concerned about something else. Why, she wondered, is everyone getting so upset about the collapse of these banks when people are still waiting for student loan relief? (Yahoo News)

Massachusetts Sen. Elizabeth Warren wrote in a Monday opinion piece for The New York Times that what happened to SVB is “the direct result of leaders in Washington weakening the financial rules,” referring to former President Donald Trump’s rollback of provisions within the Dodd Frank Act, which protected consumers from actions by big banks.

“On Sunday night, regulators announced they would ensure that all deposits at S.V.B. and Signature would be repaid 100 cents on the dollar. Not just small businesses and nonprofits, but also billion-dollar companies, crypto investors and the very venture capital firms that triggered the bank run on S.V.B. in the first place — all in the name of preventing further contagion,” Warren wrote.

“Regulators have said that banks, rather than taxpayers, will bear the cost of the federal backstop required to protect deposits. We’ll see if that’s true,” she continued. “But it’s no wonder the American people are skeptical of a system that holds millions of struggling student loan borrowers in limbo but steps in overnight to ensure that billion-dollar crypto firms won’t lose a dime in deposits.”

This probably isn’t all that unusual of a position for Warren to take. Keep in mind that she helped create the Consumer Financial Protection Bureau back in the day and was briefly considered by Barack Obama to be its first director. (She was passed over because she had no chance of being confirmed in the Senate.) Her feelings about the banks range from distrust to despisal and that tendency shows through in this op-ed.

But just to play devil’s advocate here for a moment, she does make a fairly good point when she says “we’ll see” if the banks bear the cost of these rescue operations. They are the ones in financial trouble at the moment. Granted, those problems are of their own making, but the fact remains that many of them currently have very weak portfolios. If they can’t cover their own losses, the choice will be between allowing them to go under or making the taxpayers bail them out. Which choice do you think would be made?

With that said, it’s somewhat ironic that Warren chose to tie the bank bailout question to the ongoing debate over student loan debt relief. The total amount of student debt is estimated to be in the range of $1.7 trillion. Even if Joe Biden were “only” allowed to forgive $20,000 for each of the 45 million debt-holders out there, that would still work out to $900 billion.

Guess what. All of that debt is held by lenders. You know… the people in the banking sector that issue loans? They’re already on the ropes and you want to hit them with nearly another nine trillion in losses? I think this is a pretty good reason why Warren never should have been considered for the CFPB post. Rather than regulating the banking industry, she probably would have just destroyed it and never lost a night of sleep about it in the aftermath.

Join the conversation as a VIP Member