Happy belated Tax Day, everyone. I say that while originating this column from within the Golden State, where we don’t have to obey your silly April tax deadlines. No, in California this year, not only do we not have to file until October 16th, we don’t even have to pay what we think we owe until October 16th, either to the IRS or to the state.

Historically, when some earthshaking event takes place, like an earthquake, for instance, you’re given a reprieve from filing your official paperwork. If you owe money, you still have to pay in April, or else you face penalties and interest. But this year, it’s all different. Why? Well, there’s the official reason, and then there’s the real reason.

The official reason is we had rain here. We had snow in the mountains. Tons of it. So much of it, in fact, that the climate change experts who predicted that because of climate change we’d be in the fourth year of a drought are now blaming the same climate change for not allowing the predicted climate change-caused drought from happening at all.

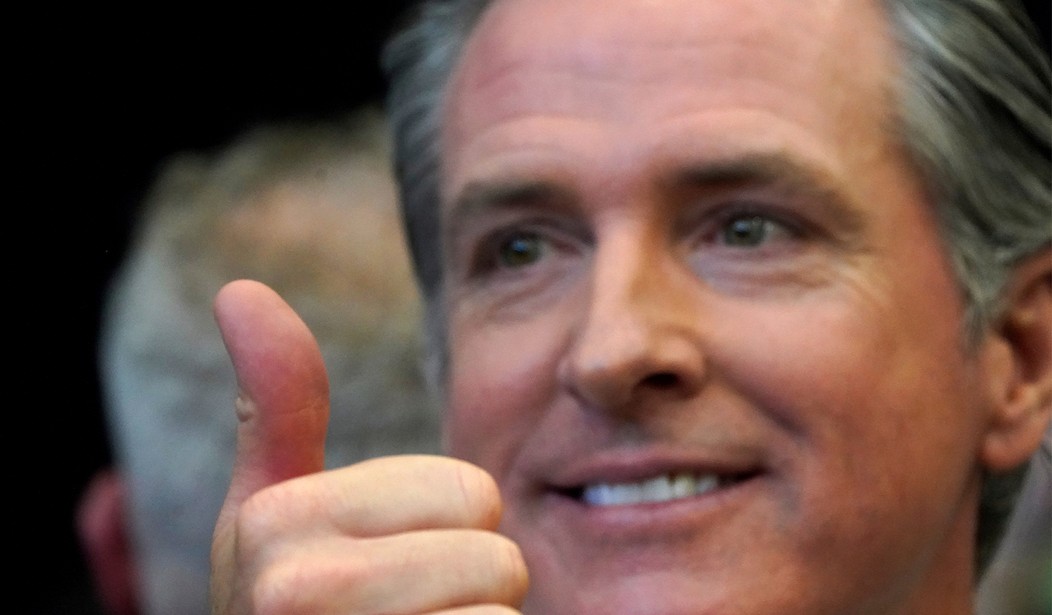

All kidding aside, I’m not going to minimize the damage to the people affected by the series of atmospheric rivers that visited the West Coast from December to March. If you’re a resident in one of the small pockets around the state where you had some property damage, like a few communities in the Sierras, or a few houses here and there that were perched on a cliff that fell into the sea when the obligatory slides occurred, the damage from the storms is very real and catastrophic. But let’s be realistic. In a state of 40 million people, the amount of people affected can be charitably stated to be about 1% of the population, and probably not even that many. Yet the calamity we supposedly face here is so extreme that Gavin Newsom called Joe Biden directly and made his pitch, and had it granted by the President, to delay the IRS filing and payment deadline in California in order to true up with the state’s deadline delay. Seems a little over-the-top on the emergency recovery scale, but that’s the official reason, that’s what media has reported, and people are just shrugging their shoulders, but happy to take the delay.

The funny thing about it is there’s not been a lot of reportage on the delay. My CPA, for instance, told me about a month ago the delay was there, but ‘we’re not supposed to really talk about it.’ I asked why they didn’t just target the deadline relief to the targeted areas, and his best guess answer was that the IRS really didn’t have a way of partitioning off returns and sorting damage areas by zip code. So it was either everybody or nobody, and Newsom made sure it was everybody. Again, we know the official reason. I found out Tuesday during my Aftershow podcast with former California Congressman John Campbell what the real reason is, and it’s evil genius.

You might recall from a few months ago that California’s budgetary rollercoaster is coming off one of the largest surplus hills it’s ever been on. hundreds of billions in COVID stimulus money will do that for you. Yet thanks to Joe Biden’s inflation, brought on by the aforementioned hundreds of billions in COVID stimulus money not just in California, but trillions nationally, along with the usual fare of poor state governance, the future of California’s economic health went from a projected $95 billion dollar surplus for 2023, predicted early last year, to a projected $24 billion dollar deficit by the fall. So California has a real problem on its hand. Enter Gavin Newsom, the Penn Gillette of governors.

Say what you will about Gavin Newsom, but he knows how to play the shell game as well as anybody in office. California’s fiscal year ends in June. They’re already going to have a surplus regardless of what money comes into the state, primarily from the afterglow of stimulus money. So if the state comes in under their expected $29 billion dollar surplus, no one’s going to notice or care, quite frankly. It’s a surplus. Maybe it’ll be $10 billion. Maybe less, maybe more. No one will focus on it or care. But when that money that would have come into Sacramento by mid-April actually comes into the state in mid-October, well after the new fiscal year beginning on July 1, those tax receipts will be applied to the 2023 budget (the one with the $24 billion deficit), not the 2022 budget with the surplus. And if enough individuals and companies take advantage of the deadline extension deal this year, the amount of money delayed to the state may wipe out next year’s deficit entirely without anything being done other than a phone call from Newsom to Biden and an accounting trick.

Make no mistake, however. California’s fiscal problems are real, severe, and compounding with interest. The fiscal year trick being employed by Governor Newsom doesn’t change any of that at all. It just merely buys him a year. It shouldn’t, though. If we had any media reporting honestly on Newsom, this sleight of fiscal hand would be made public, and Newsom wouldn’t be in a position to be able to crow about it in 2024. Keep in mind the timing of all this. Newsom is setting himself to be able to claim he stared down an economic downturn head on and neutralized it in just one year. Imagine how that will sound on a presidential campaign resume to a fawning media, should Joe Biden get stuck in an endless loop trying to count to E-I-G-H, opening the door for a Newsom for president candidacy.

So a tip of the cap to Gavin Newsom. He saw reality smack his progressive spending and fiscal track record squarely in the jaw, saw the resulting deficits that were headed his way, and conned an infirm president to go in with him on a parlor trick, one that will probably never be exposed because there’s not one decent honest political reporter in the state anymore. It’s disingenuous, it’s kicking the can down the road, and it will exacerbate the problem if interest rates remain high, but it’s political genius.