Yeah, we all know they’re lying through their teeth about the turkey, as my girlfriend Karen pointed out earlier today.

But housing prices are still high as the dickens, and why is that?

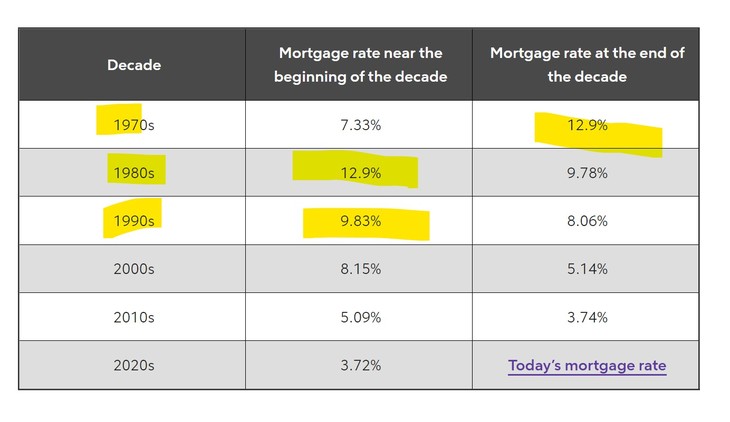

Because there’s such short supply and for a number of reasons. But the biggest is mortgage rates. Hovering just a smidge below 8%, that takes a lot of people out of the housing market who would both be buying or selling.

They’re not buying because it’s too expensive. They’re not selling because they’re already locked into a lower interest rate they are loathe to lose. It would feel as if you were trading down – you’d be buying a higher priced house and paying more for it both with what might well be 3 times your current mortgage costs and for an inflated price. Of course, you theoretically sold your house for an inflated price as well, but that never registers on the emotional side. You’re still going to feel abused.

US housing market is in a state of deadlock

30-year mortgage rates recently hit levels unseen in 2 decades

As a result, buying conditions have plummeted to levels seen only ONCE since 1960

Which ended in a severe recession

In other words: People don’t want to buy homes now… pic.twitter.com/Nd7pHIwfhW

— Game of Trades (@GameofTrades_) November 13, 2023

So many folks – us included – are sitting tight, sitting pretty, and sucking it up until things settle out.

Fewer US existing homes are selling today than at any point since 2010. The 3.79 million annual rate is even below the lowest level of sales during the 2020 covid shutdowns (4.01 million). pic.twitter.com/4OKlTAwroa

— Charlie Bilello (@charliebilello) November 21, 2023

Which is great if you have that latitude. If you have to move and maybe need to sell your house on top of it, it can be nerve racking. Prices are holding strong here in NW FL and the inventory is still pretty small, but it is taking longer. By necessity, people are also settling for less house than they would have two years ago.

There’s turned out to be another kind of interesting statistic emerging from home sales – just who’s buying them in the first place and what size.

Who's still buying homes in this market?

A: Baby Boomers (often in all-cash deals).70% of recent buyers did NOT have children under age of 18 in their homes, the highest share recorded, and well above 42% in 1985

New data via @NAR_Research @rachsieg https://t.co/bdMiHhqiZT pic.twitter.com/n7gEEIngHo

— Heather Long (@byHeatherLong) November 13, 2023

Boomers and they’re downsizing. Often they’re able to pay cash for the newer, smaller place because of the equity in the house they’re unloading.

But younger buyers are being priced out of markets.

Kind of a perfect storm brewing.

Owners with favorable mortgage rates are reluctant to sell. + Buyers, facing less competition due to high prices and larger loan costs, feel less urgency to buy.

It's an equilibrium, almost like the calm before a storm. pic.twitter.com/Mc13owB7qY

— Phoenix Capital (@PhoenixCapitalH) November 21, 2023

The video below is really instructive on the mortgage math – in fact, it’s probably the best I’ve seen. The girl narrating it takes an everyday $600K house – which used to be a breathtaking amount of money for a place, but now? I’ll bet it’s chump change in some states. And believe me – the house she uses to illustrate her point at that price has never been featured in House & Garden, if you get my drift.

It’s short and painful.

Are you a 1970s suburban home afforder?

Flaunt it… pic.twitter.com/1KpfrDXtqw

— 🤠 Weimar Silver Baron🤠 (@BankerWeimar) November 21, 2023

It also has to be so damn discouraging to people who were just about to nail that first house.

Higher interest rates are shattering housing dreams around the world. The real estate bonanza that fueled wealth for millions of people is over https://t.co/njTz6CDO0Y

— Bloomberg (@business) November 21, 2023

This is a tough one.

I remember well the 70’s and 80’s when rates shot up to just shy of 13%. Super inflationary, gruesome time.

Then again, you weren’t trying to finance $300K+.

It’s going to be a slog.

I can’t wait to get told about this #Bidenomics “disconnect,” too.

POTATUS thinks we’re all turkeys.

Join the conversation as a VIP Member