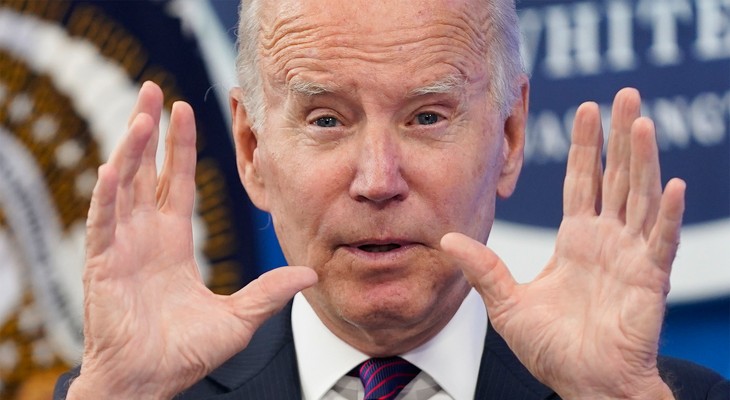

That’s a whale of an economy you’ve got there, Brandon. The good news is swirling like…well…Ty*D*Bol. It sure seems you and your team are the only ones missing the picture.

None of this is news to any of us, no matter how you insist it’s not happening or better than it was.

Beef prices were holding food down a little (it was because ranchers couldn't afford to feed their herd) That may have worked it's way through..

YoY food prices.. ouch. pic.twitter.com/N0gYdjgJYY— Frog Capital (@FrogNews) March 14, 2023

You’d think chicken would be one of the bright spots as inflation roars its way through family budgets, and especially a brand-name affordable poultry producer. But it’s not.

Tyson Foods will close two chicken plants in May, affecting nearly 1,700 employees.

“While the decision was not easy, it reflects our broader strategy to strengthen our poultry business by optimizing operations and utilizing full available capacity at each plant,” Tyson said in a statement to CNBC.

In its latest quarter, Tyson’s chicken business underperformed expectations as its operating income was halved compared with the year-ago period.

They did HALF the chicken business they did a year ago? [Correction: their operating income was halved and, while chicken sales increased, the number didn’t meet the projected target]

UPDATE: Building on that correction, Tyson’s recent Q1 2023 earnings report was abysmal and considered a “wide miss”:

Springdale, Ark., meat processor Tyson Foods reported net income of $316 million, or 88 cents a share, for the first quarter of fiscal 2023 — missing consensus estimates by nearly 50 cents a share and coming in significantly lower than last year’s Q1 results.

…This year’s results represented a 68% decline off last year’s Q1 results of $1.12 billion — which were nearly three times higher than 2021 Q1 results, driven predominantly by higher prices and consistently high demand for meat and poultry products.

If you ignore the fact the regional banking system is collapsing.. there is no reason for the idiots at the Fed to stop hiking here pic.twitter.com/B0ljRwoiM2

— Frog Capital (@FrogNews) March 14, 2023

Then again, there could be some other expenses they’re dumping in connection with the one plant they plan to shutter just northwest of Richmond, VA. Makes you wonder if, in hard times, this sort of legal action is going to have significant repercussions.

…The Glen Allen announcement came the same day 34 Tyson Foods employees, former employees and family members filed a lawsuit against the company, saying it failed to take appropriate precautions at its meat-packing plants during the early days of the COVID pandemic.

In expected, but surprisingly deeper than anticipated job cuts, Facebook parent Meta is taking a knife to its operations yet again.

10,000 job cuts, with an additional 5000 open job positions being closed. This is after the 11,000 they let go in November and Zuckerberg wasn’t saying that was the end of it.

…“Here’s the timeline you should expect: over the next couple of months, org leaders will announce restructuring plans focused on flattening our orgs, canceling lower priority projects, and reducing our hiring rates,” Zuckerberg said in a message to employees, which was also posted to the technology company’s blog.

He added that the Facebook parent plans to close 5,000 additional open roles that it hasn’t yet filled. In a nod to continued economic uncertainty, Zuckerberg noted that the company should prepare for “the possibility that this new economic reality will continue for many years.”

Apple has its share of tech industry pain this year, too – don’t think it doesn’t. While they haven’t laid anyone off, there’s a hiring freeze on, and now the brakes have come on for what used to be twice-yearly employee bonuses.

…In addition to slowing hiring, Apple is planning to reduce the frequency of bonuses for some of its corporate workforce. Apple normally provides bonuses and promotions once or twice per year depending on division, with the extra money paid out in April and October, but the company is shifting entirely to a once-per-year bonus schedule. Bonus payments will be provided in October for all teams, and employees are still set to receive their full bonuses.

Unlike many of the other companies, being the touchy-feely emotive bunch they are, Apple CEO Tim Cook is suffering a salary cut-back right along with the hired help.

…Apple CEO Tim Cook is also being paid less this year, and he is set to receive $49 million in salary, bonuses, and stock awards, down approximately 50 percent from the $99 million he was paid in 2022.

He’s right down there in the trenches with the knuckledraggers. Tough times call for tough leadership.

…“Well, we invest for the long term, and we run the company for the long term. And so if you look at what we’re doing, we’re also recognizing the environment that we’re in is tough. And so we’re cutting costs. We’re cutting hiring. We are being very prudent and deliberate on people that we hire. And so a number of areas in the company are not hiring at all,” Cook told CNBC in February.

…Last month, Apple announced December quarter earnings which were about 5% lower than they were in 2021, its first year-over-year revenue decline since 2019.

As for declines, that’s exactly what the entire U.S. banking sector was doing today on Moody’s index. Everyone had been watching, because Moody’s had put 5 or 6 of the regionals most at risk on a review watchlist, and when the announcement came?

Oh, it was like being on Oprah – EVERYBODY GETS A PRESENT!

Moody’s went and downgraded the whole dang thing.

Moody's downgrades U.S. banking system's outlook to negative citing bank runshttps://t.co/8SuoPlkWZk

— FOX Business (@FoxBusiness) March 14, 2023

Moody’s Investor Service cited more than the bank runs, in point of fact. The entire inflationary cycle got a big finger pointed right at it and it’s not going to get better any time soon. Their prediction for later this year is bald-faced dismal.

…Moody’s analysts said although the Treasury Department, Federal Reserve and Federal Deposit Insurance Corporation (FDIC) developed a plan to make SVB depositors whole in an effort to bolster confidence in the banking system, other institutions remain vulnerable to the same problems that sank SVB as they expect the central bank to continue raising interest rates.

The report explained the U.S. banking sector experienced “significant excess deposit creation” thanks to a combination of pandemic related stimulus after more than a decade of ultralow interest rates and quantitative easing by the Federal Reserve.

As monetary tightening continues, the analysts believe, asset risk metrics will rise over the next 12 to 18 months from historic lows as rising rates continue to reduce debt affordability and threaten financial conditions.

…”We expect banks will need to increase reserves as the economy worsens later in the year,” the report states.

“Banking sector stresses could, in turn, be detrimental to the broader economy, worsening banks’ asset risk.”

I love to cook, so I love to shop. I go into Publix now and I hate it. I made a quick casserole last night and had most of the ingredients and still spend 20 bucks.

The economy is a freaking disaster.

— Maze (@pordadow) March 9, 2023

Yes, it is.

“AS THE ECONOMY WORSENS LATER IN THE YEAR”

Don’t anybody tell The Big Guy. His babysitters will jack it up worse if they possibly can.

Join the conversation as a VIP Member