Senator Elizabeth Warren apparently calls this the "tax doom loop" which is a pretty twisted way of framing things. The "tax doom" in this case refers to the fact that, given a choice, most Americans would rather not pay higher taxes. As for the "loop" part of the formula, that arises from the fact that we have a two party system in which the Republican Party is able to run on this issue of taxes and occasionally even cut taxes, leaving progressive Democrats with a major problem. How can they keep spending money they don't have?

It goes like this: Republicans pass huge tax cuts that are, at first, only temporary. By the time the tax cuts are set to end, Americans have become used to owing less to the government. Hesitant to raise taxes, Democrats join with Republicans to continue many of the cuts indefinitely.

To liberals, this cycle is to blame for a range of social and economic ills. Widening inequality. Ballooning deficits. A federal government without the resources to pay for a progressive agenda.

But now there is hope on the horizon that next year could be the year progressives finally get to raise your taxes like they've been wanting to. And the best part is they don't have to actually do anything. [emphasis added]

That’s because much of the last large Republican tax cut, a 2017 law signed by President Donald J. Trump, will expire after 2025. Progressive tax experts and activists have spent years organizing to convince the Democratic Party that rather than simply extending the cuts, it needs to ensure the United States brings in more tax revenue so it can finance more generous social programs.

There's just one problem with this progressive daydream. It turns out that Kamala Harris (or whoever is telling her what to say) has already ruled out a tax increase on everyone but the very wealthy. In the same way she's suddenly become a border hawk, Harris is effectively defending the Trump tax cuts.

While Vice President Kamala Harris has pledged to raise taxes on high-income Americans and corporations, her presidential campaign has also said she would not raise taxes on any household making less than $400,000. That means she, too, wants to continue much of Mr. Trump’s tax cut.

“They’ve already lost that battle,” said Rohit Kumar, a former aide to Senator Mitch McConnell, Republican of Kentucky, and co-leader of PwC’s national tax office. “For progressives to win the battle that they think they’ve been losing, they would have to convince the president and the Congress to contemplate a fairly significant middle-class tax hike. And that’s partly why they haven’t been successful.”

Nevertheless, progressive still hope that they can eek out some kind of win next year. Their argument is that if the entire thing expires it really won't be that bad for middle class taxpayers.

This is not a smart way to look at things. Anyone who remembers George H.W. Bush remembers his pledge ("read my lips") not to raise taxes. If Harris somehow wins and becomes president, she will be in the same position. It Democrats allow the tax cuts to expire she'll have broken a promise, one that will nicely set up the next round of the "tax doom loop" when Republicans will run on the issue of rolling back the increase.

Unfortunately, this topic seems to have brought out a host of truly ignorant commenters. Here is the top comment:

Taxes are the price for a functional society, period. The rich need to get used to being active contributors to the society that allowed them to become & stay wealthy, instead of continuing to hoard & whine. Politicians ought to finally turn their focus to helping those who are not on the moneyed end of the economic spectrum. I’m tired of the handwringing over this issue when high taxes and solid services were once as American as apple pie.

This is dumb in so many ways, I don't know where to start.

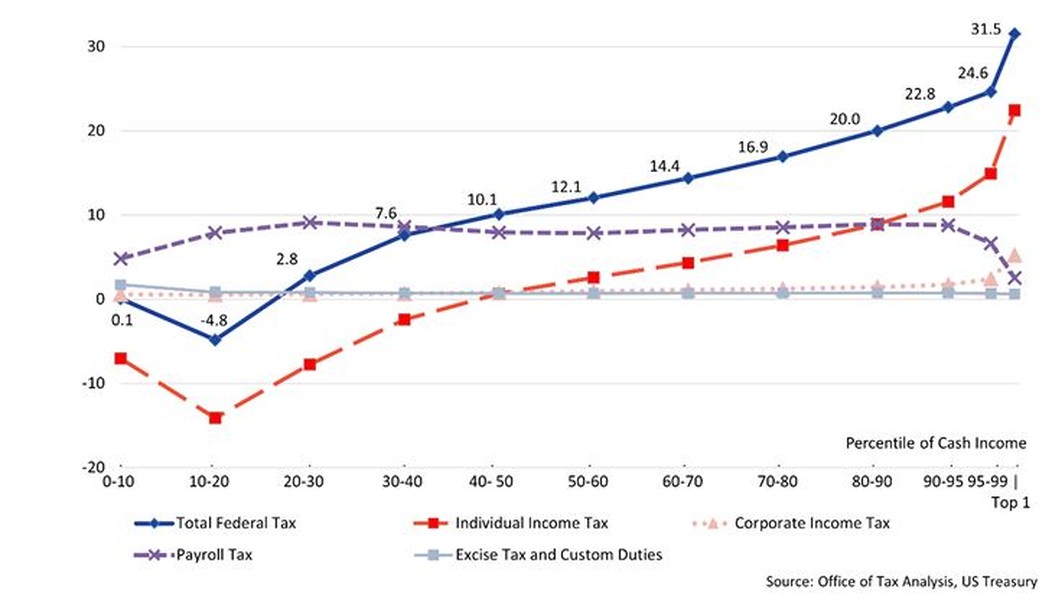

- The rich are already "active contributors" who pay the overwhelming majority of federal taxes in the US. Contrary to Biden's many lies on this topic, the top 1% pay far more than secretaries. (See chart at the top of this story.)

- The rich don't "hoard & whine" they produce things that other people use. I'm sure the dope who wrote this orders from Amazon frequently.

- Politicians have already turned much of the US budget to those who are not on the moneyed end of the spectrum. We have Social Security, Medicare, Medicaid, etc. which make up a large percentage of federal and state budgets.

- High taxes are not a given in America. We had no income tax until the Civil War and then it only lasted about a decade. It didn't return until passage of the 16th Amendment in 1913. Even then taxes were negligible with a top rate of 7%. The tax rate peaked during WWII at 94% for obvious reasons.

- Scandinavian countries with bigger social safety nets do not attempt to soak the rich but spread the burden down to much lower incomes. This is they only way to pay for these schemes as "the rich" do not have enough money to cover them, not even with a wealth tax.

Someone did respond to that comment above with a few facts:

The top 10% of income earners in the U.S. pay about 75% of all federal personal income taxes, while the bottom 50% pay nothing. The middle 40% covers the remaining 25%. These figures illustrate the progressive nature of the U.S. tax system, where higher earners contribute significantly more. While it's theoretically possible for the "rich" to pay more, there isn't much room to increase their contributions without potentially harming the economy — an outcome that some policymakers might not necessarily oppose.

Anyway, good luck to progressive Dems trying to end the "tax doom loop." They will likely fail and still damage their prospects in the next election for trying. And if they somehow succeed, then they will be the ones doomed for it.

Join the conversation as a VIP Member