Has an ill wind begun to blow through the American economy? Or did the job market just have a one-month hiccup?

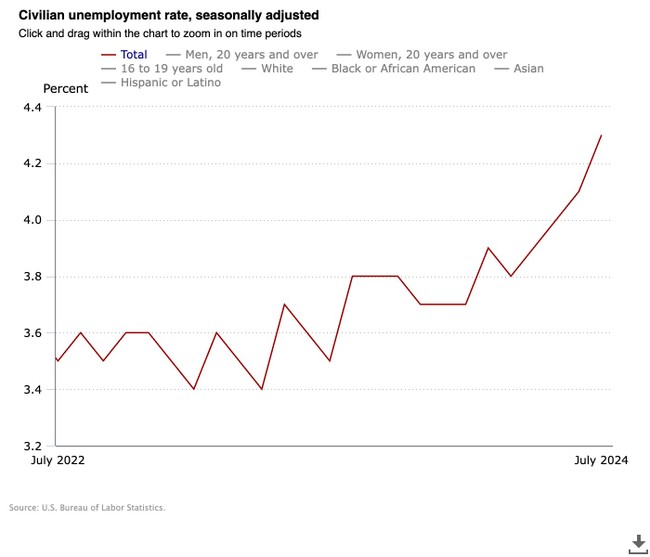

The Bureau of Labor Statistics delivered a big miss on expectations in its July employment report this morning. Economists expected job creation numbers to drift downward a bit, perhaps to a still-sufficient maintenance level of 185,000. Instead, job creation fell to 114,000 in July and unemployment ticked up to 4.3%. And the slide looks even more significant when reviewed against the 2023 data:

The unemployment rate rose to 4.3 percent in July, and nonfarm payroll employment edged up by 114,000, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in health care, in construction, and in transportation and warehousing, while information lost jobs. ...

The unemployment rate rose by 0.2 percentage point to 4.3 percent in July, and the number of unemployed people increased by 352,000 to 7.2 million. These measures are higher than a year earlier, when the jobless rate was 3.5 percent, and the number of unemployed people was 5.9 million. (See table A-1.)

This appears to be real unemployment, as opposed to a statistical anomaly in the Household survey (which can be prone to short-term variations). One key labor-force measure has declined significantly over the past year, emphasis mine:

The labor force participation rate, at 62.7 percent, changed little in July and was little changed over the year. The employment-population ratio was little changed at 60.0 percent in July but is down by 0.4 percentage point over the year. (See table A-1.)

The number of job seekers not in the labor force went up significantly, by 366,000, but that is the kind of variation that sometimes happens in the Household survey. It has declined in the previous month as well, so that may not be a very reliable indicator However, the employment-population ratio changes over the past year seem to indicate some real erosion in the job markets, especially when combined with the significant climb in the unemployment rate.

In somewhat better news, wages still went up, but only barely past the rate of inflation. The average hours work declined again, though:

In July, average hourly earnings for all employees on private nonfarm payrolls increased by 8 cents, or 0.2 percent, to $35.07. Over the past 12 months, average hourly earnings have increased by 3.6 percent. In July, average hourly earnings of private-sector production and nonsupervisory employees increased by 9 cents, or 0.3 percent, to $30.14. (See tables B-3 and B-8.)

The average workweek for all employees on private nonfarm payrolls edged down by 0.1 hour to 34.2 hours in July. In manufacturing, the average workweek edged down by 0.2 hour to 39.9 hours, and overtime edged down by 0.1 hour to 2.8 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls edged down by 0.1 hour to 33.7 hours. (See tables B-2 and B-7.)

Revisions to previous months' reports were negative but minor, removing 29,000 previously reported new jobs from May and June. Most of that came from last month, though, bringing the number down from 206K to 179K, which looks much more like treading water than a healthy job market. And with unemployment trending upward for the past year, the charts are definitely going in the wrong direction for an administration defending its record in an election in three months:

Nor is this the only warning sign of an economic slowdown approaching. The Wall Street Journal sends up a flare or two on the data as well:

Nor is this the only warning sign of an economic slowdown approaching. The Wall Street Journal sends up a flare or two on the data as well:

America is still adding jobs. But the labor market’s strength has been fading, and Friday’s report adds to evidence that it could be on its way to weakness. ...

But other labor market measures are flashing warning signs.

The pace of hiring has slowed markedly, with the Labor Department on Tuesday reporting that the hires rate—the number of hires as a share of total jobs—slipped to 3.4% in June, marking its lowest level since April 2020, when the pandemic had just hit the economy. In 2019, that rate averaged 3.9%. One reason that the economy has been able to keep adding jobs despite the low hires rate is that layoff activity has been muted, too, with the June layoff rate matching its lowest level on record.

So what's next? The Federal Reserve had already indicated a rate cut in September based on softening data they'd already seen. But that may be coming too late and likely too small for Wall Street investors that are getting spooked by a potential recession, CNBC warns, especially because the data may be worse than the toplines indicate:

While the survey of establishments used for the headline payrolls number was discouraging, the household survey was even more so, with growth of just 67,000, while the ranks of the unemployed swelled by 352,000. The labor force also contracted by 214,000, though the participation rate as a share of the working-age population actually edged higher to 62.7%. ...

Though markets on Wednesday cheered indications from the Fed that an interest rate cut could come as soon as September, that quickly turned to trepidation when economic data Thursday showed an unexpected jump in filings for unemployment benefits and a further weakening of the manufacturing sector.

That triggered the worst sell-off of the year on Wall Street and renewed fears that the Fed may be waiting too long to start cutting interest rates.

The rise in the unemployment rate brings into play the so-called Sahm Rule, which states that the economy is in recession when the three-month average of the jobless level is half a percentage point higher than the 12-month low. In this case, the unemployment rate was 3.5% in July 2023 before it began its gradual ascent. The three-month unemployment rate average moved up to 4.13%.

We aren't in a recession yet; the advance Q2 GDP number was a relatively healthy 2.8%. But we could be headed that way, and Jerome Powell may find himself under pressure to deliver a rate cut sooner than expected. And this belies the claims that the economy is still heading in the right direction, at least for the moment.

Join the conversation as a VIP Member