Has inflation begun “easing,” as media outlets report this morning? The annualized number for the Consumer Price Index look marginally better, but not enough to matter for American households. And based on the fundamentals in this report, the slight respite it does show may not last long.

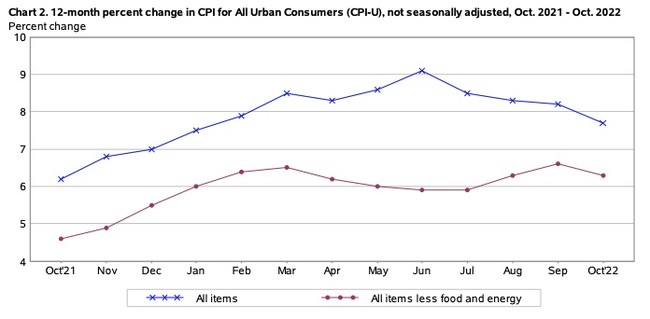

Annual CPI inflation dropped under 8% for the first time in ten months, coming in at 7.7%, but month-on-month inflation rose 0.4% for the second straight month — and shelter costs rose twice as fast, its highest rate in several months:

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in October on a seasonally adjusted basis, the same increase as in September, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.7 percent before seasonal adjustment.

The index for shelter contributed over half of the monthly all items increase, with the indexes for gasoline and food also increasing. The energy index increased 1.8 percent over the month as the gasoline index and the electricity index rose, but the natural gas index decreased. The food index increased 0.6 percent over the month with the food at home index rising 0.4 percent.

The index for all items less food and energy rose 0.3 percent in October, after rising 0.6 percent in September. The indexes for shelter, motor vehicle insurance, recreation, new vehicles, and personal care were among those that increased over the month. Indexes which declined in October included the used cars and trucks, medical care, apparel, and airline fares indexes.

The all items index increased 7.7 percent for the 12 months ending October, this was the smallest 12-month increase since the period ending January 2022. The all items less food and energy index rose 6.3 percent over the last 12 months. The energy index increased 17.6 percent for the 12 months ending October, and the food index increased 10.9 percent over the last year; all of these increases were smaller than for the period ending September.

Both overall and core CPI rates fell slightly in October. These changes are incrementally positive and still better than going the other direction, but are yet well above where they were a year ago. Core CPI is still higher than it was this summer, in fact:

The month’s inflation rates were mainly helped by significant price reductions in used vehicles (-2.4% for the month) and apparel (-0.7%). Almost everything else kept going up in October, including food (0.6%), energy (1.8%), and especially shelter (0.8%) — primarily felt in lodging away from home (4.9%) and hotels/motels (5.6%), but also in regular rent (0.7%) and in homeowner costs (0.6%).

Perhaps most worrisome for Americans in cold-weather states is inflation on heating energy. Fuel oil prices rose 19.8% in October alone after dropping the previous two months. Some households will struggle to keep the heat on in their homes this winter with prices escalating at these rates, and that may have deadly consequences.

Also, despite Joe Biden’s bragging of late on gas prices at the pump, those costs went up 4% in October alone. The “other” category, presumably including diesel, rose 3%. That’s the first significant jump in three months, and it will start getting reflected in prices for other goods and services soon if those increases continue.

Nevertheless, most media focused on the upsides. Jeff Cox at CNBC notes that the report beat expectations:

The consumer price index rose less than expected in October, an indication that while inflation is still a threat to the U.S. economy, pressures could be starting to cool.

The consumer price index, a broad-based measure of goods and services costs, increased 0.4% for the month and 7.7% from a year ago. Respective estimates from Dow Jones were for increases of 0.6% and 7.9%.

Excluding volatile food and energy costs, so-called core CPI increased 0.3% for the month and 6.3% on an annual basis, compared to respective estimates of 0.5% and 6.5%.

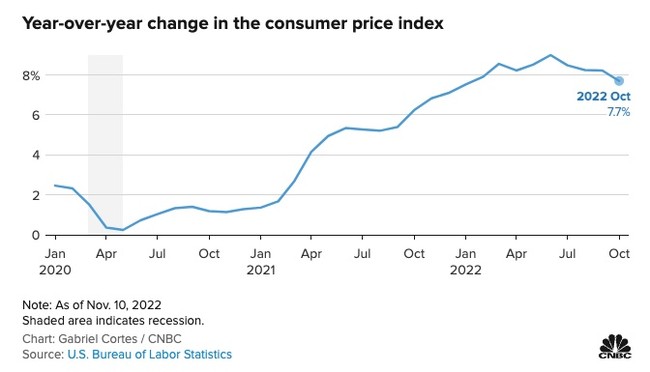

“Rose less than expected” is actually a very accurate way of putting this. Let’s not forget that inflation reports compound, thanks to the nature of comparative measures. They measure prices increases on monthly and annual bases. Any increase is still an increase, and 7.7% is still a phenomenal rate of inflation historically for the US. It also compares to the October 2021 inflation rate, which was itself 6.2% over the October 2020 rate. CNBC’s chart reminds us of that:

This isn’t a reduction in inflation, but merely an incremental reduction in its rate of increase. Keep that in mind as you read media analyses of this report. And when you hear the White House claim — again — that they’ve eliminated inflation.

Join the conversation as a VIP Member