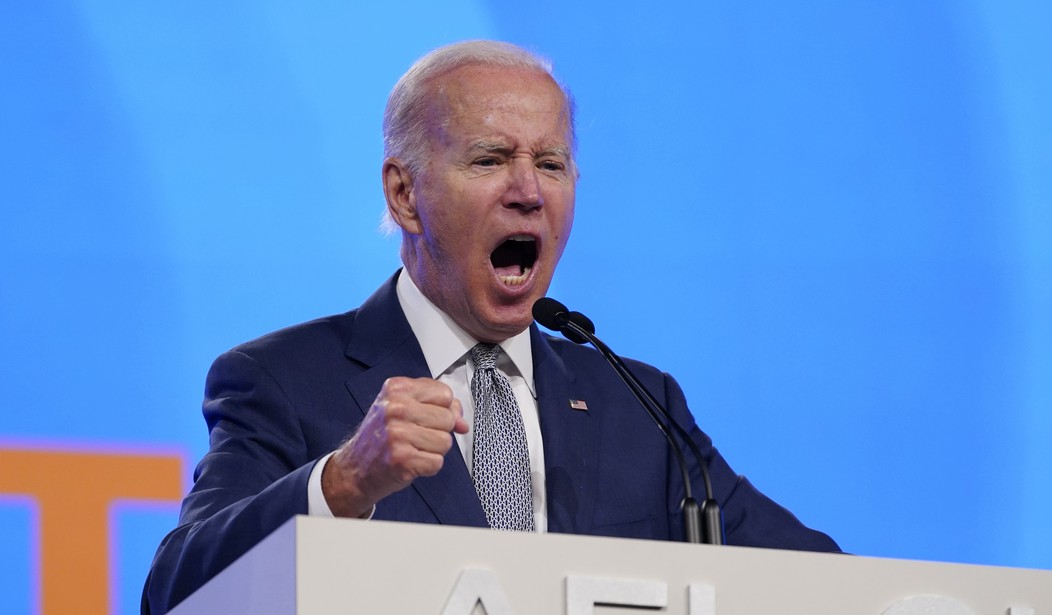

Every once in a while, Joe Biden manages to tell the truth. “We’re changing people’s lives!” Biden shouted this week to an AFL-CIO meeting, defending his reckless spending.

Biden, visibly angry: "I don't want to hear anymore of these lies about reckless spending. We're changing people's lives!" pic.twitter.com/0I3OgmIJGD

— Townhall.com (@townhallcom) June 14, 2022

And by golly, Biden turned out to be correct — he’s changing people’s lives, or at the very least their retirements and spending ability. Skyrocketing inflation that Biden triggered with his March 2021 American Rescue Plan had already sent the markets into bear territory before the Federal Reserve finally took significant action to curtail it yesterday. Today’s markets are registering the reality of the end of the funny-money era:

The stock rally prompted by the Federal Reserve’s biggest rate increase since 1994 reversed course Thursday morning, with U.S. indexes falling sharply in early trading. All three benchmarks retreated, with the Dow Jones Industrial Average shedding about 800 points and all 11 of the S&P 500’s sectors falling into the red.

The Fed increased interest rates by 0.75 percentage point Wednesday, signaling a much more aggressive path to fight 40-year-high inflation.

While investors originally welcomed the move, the optimism fizzled as they contemplated the danger posed to the economy.

That put the DJIA below the 30K mark for the first time since Biden got inaugurated, CNBC reported. The S&P and NASDAQ have already entered bear territory, and it looks like the Dow Jones won’t be far behind:

The Dow Jones Industrial Average tumbled below the key 30,000 level on Thursday as investors worried the Federal Reserve’s more aggressive approach toward inflation would bring the economy into a recession.

The Dow had rallied on Wednesday after the Fed announced its largest rate hike since 1994, but reversed those gains and then some on Thursday, tumbling to the lowest level since January 2021. …

The Dow on Thursday traded below 30,000 for the first time since Jan. 4, 2021 after first breaking above that level for the first time in November 2020. That came as the emergence of Covid-19 vaccines and massive stimulus from the Fed fueled a broader market rally — led by tech shares — and took the major averages to then-record highs.

Breaking above the 30,000 mark put the Dow more than 60% above its pandemic closing low at the time. While 30,000 isn’t necessarily a technical level for the Dow, these round 1,000-point thresholds are seen by many on Wall Street as key psychological levels for the market.

Yesterday’s ‘unexpected’ report on a drop in consumer spending in May doesn’t help with investor confidence, either. The -0.3% decline in month-on-month spending isn’t adjusted for inflation. That means that the decline was actually somewhat worse, since the month-on-month increase for May in the consumer price index was 0.8%. That’s just one month’s report, and PCEs were actually fairly decent in Q1 at 3.1%, but it’s yet another warning signal that the consumers who drive economic growth in the US economy may have reached their limit in Bidenflation erosion of their buying power.

And it’s about to get much worse, thanks to the Fed action yesterday, necessary as it might be. Mortgage rates spiked overnight by the biggest margin in 35 years, throwing a monkey wrench at strategies for managing most Americans’ biggest asset:

Average long-term U.S. mortgage rates had their biggest one-week jump in 35 years with the Federal Reserve this week raising its key rate by three-quarters of a point in bid to tame high inflation.

Mortgage buyer Freddie Mac reported Thursday that the 30-year rate climbed from 5.23% last week to 5.78% this week, the highest its been since November of 2008 during the housing crisis. Wednesday’s rate hike by the Fed was its biggest in a single action since 1994.

The brisk jump in rates, along with a sharp increase in home prices, has been pushing potential homebuyers out of the market. Mortgage applications are down more than 15% from last year and refinancings are down more than 70%, according to the Mortgage Bankers Association.

That’s certainly going to change people’s lives, and not for the better. And it’s not just in the way that higher mortgage rates will lock out a lot of potential homebuyers, although that certainly is the case. It will also mean that people who purchased homes over the last few years will have much less leverage to relocate, thanks to the impact that the big jump in mortgage rates will have on their ability to buy a new house. Those who have to relocate for jobs will suddenly find themselves losing the buying power they would have otherwise gained in taking a new job, which could slow down hiring … assuming a recession doesn’t pop the jobs bubble of the post-pandemic period, too.

The slowdown on refinancing is equally worrying, if not more so. People refinance for many reasons, but almost all of them involve either purchasing power. Refinancing for debt consolidation saves money, for instance, while refinancing for home improvements prompts significant big-ticket spending. Much of that will dry up in the coming months, which likely will result in a significant slowdown of consumer spending in the short to medium term.

That won’t help the stock markets either, and that brings us to fixed-income households that depend on stocks and bonds for their buying power. This bear market has already wiped out some of the wealth accrued by Americans over the last few years, and most of them aren’t millionaires either. Most of them are people who have spent decades investing in IRAs and 401K retirement plans, who now may need to cut back spending as their net worth plummets.

Joe Biden’s changing lives indeed. He’s wrecking them.

Join the conversation as a VIP Member