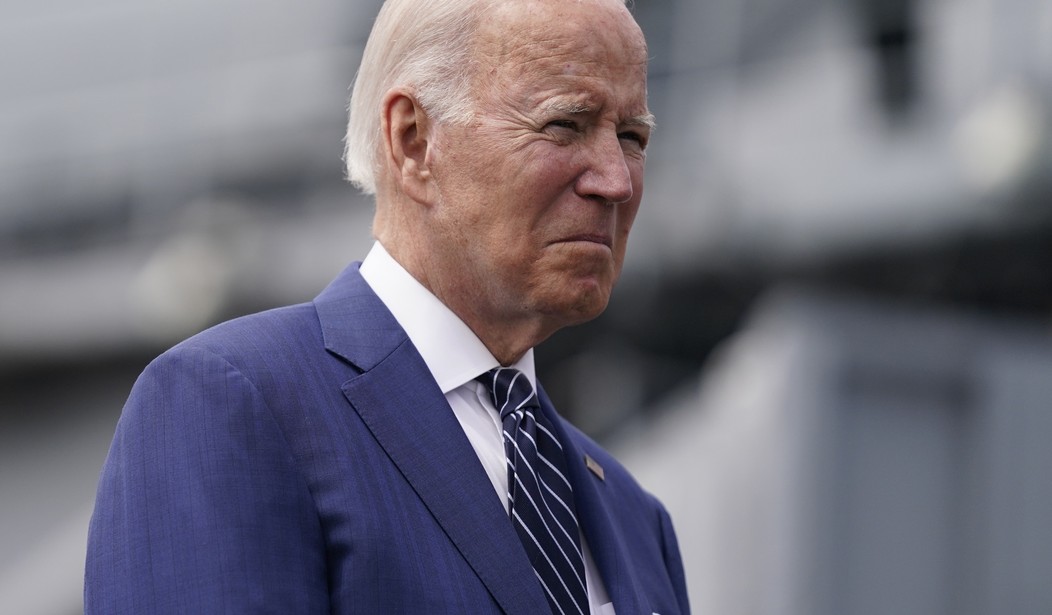

Why did corporate greed only become acute under Joe Biden? Pressed to explain the supposedly unexpected further increase in the rate of inflation, Biden offered a couple of golden oldies from his basket of distractions. As Allahpundit noted yesterday, Biden trotted out his “Putin price hike” excuse, even though Biden had been in denial for most of 2021 about inflation running away in the US — offering lame excuses that had even tired out the Washington Post editorial board by early January, well before the invasion.

Biden spent even more time on his “corporate greed” attack lines, undaunted by their failure for the last several months. He went out of his way to attack ExxonMobil specifically, who he claimed not only “made more money than God” but also didn’t pay taxes:

“Why don’t you tell them what Exxon’s profits were this year? This quarter? Exxon made more money than God this year,” he said in remarks at the Port of Los Angeles. “Exxon, start investing. Start paying your taxes.”

I doubt Joe Biden even knows what ExxonMobil’s taxes or profits are, but it’s easy enough to check. (One has to wonder why media outlets don’t check on this, too.) As a publicly traded company, ExxonMobil publishes quarterly reports on earnings and profits. Their latest report came out just six weeks ago for the first quarter of this year, with a comparison to 2021Q1. Let’s look at the relevant points from the report, figures in billions and 2021Q1 figures in parentheses:

- Overall revenue: 90.5 (59.1 in 2021Q1)

- Total costs: 81.944 (55.555)

- Income before taxes: 8.556 (3.592)

- Income taxes: 2.806 (0.796)

- Net income (profit): 5.48 (2.73)

Why were sales so much higher this year than the same period last year? The same reason total costs were so much higher — inflation. ExxonMobil did a bit better on net profit margin this quarter at 6%, compared to 2021Q1’s 4.6%, but both are generally in the range of the oil industry’s normally narrow profit-margin average of about 5%. Their tax rate on income was hardly zero; they paid a 32.8% effective income tax rate in 2022Q1, far higher than their 22.2% effective income tax rate in 2021Q1.

This should put a stake through the heart of any “price gouging” claims, too, although that’s one demagogic complaint Biden didn’t make yesterday. ExxonMobil doesn’t set prices at the pump anyway; station owners do that, usually by trying to project what it will cost them to refill their tanks the next time they get supplied. But even apart from that, a 6% margin isn’t a product of price gouging.

Basically, everything Biden just said about ExxonMobil’s bottom line was a lie. They had to spend $82 billion to make $5.5 billion, so they didn’t make “more money than God” in Q1 or any other quarter. A 6% return on investment might not be bad, but it’s hardly spectacular. In fact, as CFA Journal notes, that’s about the average for the energy sector as of mid-2021, and far lower than other industries:

Let’s look at an example from the #1 profit-margin industry: Goldman Sachs. Democrats get a lot of support from Goldman Sachs (and so do some Republicans), plus GS execs tend to turn up as economic advisers to Democratic presidents, including Biden himself. How does Goldman Sachs’ financials stack up against ExxonMobil’s? Let’s see what Goldman Sachs reported for Q1, figures in billions and 2021Q1 in parentheses:

- Overall revenue: 12.933 (17.704)

- Total costs: 7.716 (9.437)

- Income before taxes: 4.656 (8.337)

- Income taxes: 0.717 (1.501)

- Net income (profit): 3.939 (6.836)

Goldman Sachs ended 2022Q1 with a net profit margin of 30.5%, a rate roughly five times higher than that of ExxonMobil. They did even better in 2021Q1, scoring a 38.6% net profit margin. Goldman Sachs’ effective income tax rate in the last quarter was 15.4%, less than half that of ExxonMobil, and it was only 18% in 2021Q1.

So who’s making more money than God, and who’s keeping more of it? Hint: it ain’t ExxonMobil. In fact, in Q1 ExxonMobil paid four times as much income tax as Goldman Sachs in real-dollar terms. And note that in both cases, the bottom lines have been remarkably consistent between the pre-inflation and inflation eras. The level of “corporate greed” hasn’t budged, so that’s clearly not the explanation for inflation.

This brings up another point. Which of these industries would investors choose to maximize their return on investment? Hint: that ain’t ExxonMobil or oil companies either, largely because of the tight margins and the policy hostility toward their operations. That hostility — especially Biden’s brain-dead class-warfare demagoguery — is hampering our ability to expand production in the US in a very real way.

Next, Biden turned to shipping companies and offered a strange conspiracy theory to explain inflation:

There are nine — nine major ocean line shipping companies that ship from Asia to the United States. Nine. They form three consortia. These companies have raised their prices by as much as 1,000 percent. So everything coming from Asia, they — they get 90-some percent of it — the stuff coming from Asia. They’ve raised it by 1,000 percent.

That’s why I called on Congress to crack down on — and they’re foreign owned — foreign-owned shipping companies that raise their prices while raking in, just last year, $190 billion in profit — a seven-fold increase in one year. Seven-fold increase — $190 billion.

Biden didn’t bother to name any of the nine shippers or identify the three “consortia” that’s supposedly doing this price fixing. People can dig around to find out their identities and alliances fairly easily. The top two shippers, MSC and Maersk, indeed have their own consortium that controls about a third of international shipping, with the other two consortia and seven shippers controlling another third. It’d be too long and tiresome to go over all nine, but MSC reported an operating margin of 10.7% in 2022Q1 and net income of $66.1 million on sales of $848.547 million (net margin of 7.8%), although their fiscal year started in August 2021 — so that’s reflecting last year’s efforts. Maersk did much better; they had a net margin of 35.2% (and this reflects the calendar 2022Q1).

However, he also didn’t explain how this suddenly started happening in April 2021, either. Maersk had a net margin of 29% for all of FY2021, for instance, while MSC’s 2021Q1 took place in the middle of the global shutdowns and still got a net margin of 5%. These consortia and market concentrations certainly have an impact on prices, but even there, the existence of three “alliances” and nine companies covering 67% of the world markets probably still creates price tensions between the players. And these consortia have been around a good long while, under the aegis of the EU, which regulates them on five-year cycles. And even then, the results haven’t exactly been rampant price-gouging, as this report from 2019 demonstrates:

In the past two years, the major liner carriers in the east-west trades have reorganized themselves into three space sharing alliances — the 2M Alliance of Maersk and MSC; the Ocean Alliance of CMA CGM, COSCO Shipping, OOCL (now 75 percent owned by COSCO) and Evergreen; and THE Alliance of Hapag-Lloyd, Ocean Network Express and Yang Ming.

Data from BlueWater Reporting shows that in the Asia-North Europe trade, the Ocean Alliance has a 40 percent share, the 2M Alliance a 32 percent share and THE Alliance a 26 percent share. In the North Europe-North America trade, Bluewater says the 2M Alliance has a 50 percent share, THE Alliance has a 30 percent share and the Ocean Alliance a 16 percent share.

While carriers share space on alliance ships they also compete vigorously with each other and the industry had an operating loss of more than $3 billion last year.

Even if shipping consortiums and their “corporate greed” are the initiators of inflation — and they’re not — Biden still didn’t explain why his administration is only now identifying this as a major cause for inflation over the past six weeks or so. The supply-chain crisis has been ongoing for the entirety of Biden’s presidency, and he has yet to provide a consistent and sustained effort to deal with it, unless cornered by reporters on the inevitable outcomes of shortages and high prices. Even if one wants to believe that Biden understands shippers’ P&L statements better than ExxonMobil’s, it’s still an indictment of Biden for incompetence and dereliction of duty.

These are the reasons that “corporate greed” is just a demagogic cop-out for executive incompetence at the White House. And the fact that Biden still hasn’t changed direction on any of these policies while still spouting utter lies about American firms operating in the environment Biden created demonstrates that we’re in for years of these demagogic cop-outs.

Update: As far as Biden’s claim that ExxonMobil isn’t investing in its own business, the numbers here show that to be hogwash. But just in case anyone’s forgotten, here was Joe Biden on the campaign trail in 2020:

Joe Biden in 2020: "No more subsidies for the fossil fuel industry. No more drilling including offshore. No ability for the oil industry to continue to drill period. It ends." pic.twitter.com/90MVJevPmv

— Dan O'Donnell (@DanODonnellShow) March 8, 2022

Biden’s executive order 13990 issued on his first day in office made sure to impose enough costs and regulatory obstacles to make that promise a reality.

Join the conversation as a VIP Member